Best Selling Cars List of 2023!

- managementpunditz

- Jan 22, 2024

- 4 min read

Highlights

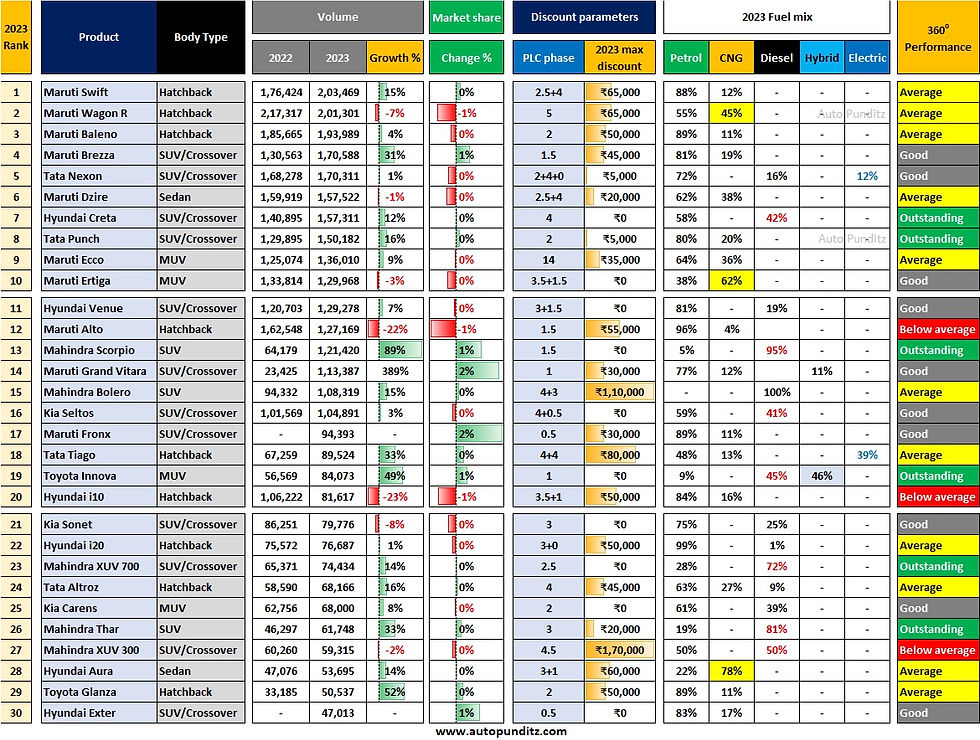

The Maruti Swift became the best-selling passenger vehicle in India.

The Maruti Brezza is the best-selling SUV/crossover, followed by the Tata Nexon.

4 SUVs/Crossovers occupy the top 10 ranking, followed by 3 hatchbacks, 2 MUVs, and only one sub-4m sedan.

The top 30 products command 82% of the PV market share.

20 of the top 30 products were having some form of discount throughout 2023.

Prelude: Understanding Product-life-cycle (PLC)

In the automotive industry, each generation of product has two distinct phases in the product-life-cycle (PLC). Phase one starts with a new generation launch based on a completely new platform or modified existing platform or the same platform with a different body shell, followed by successive model year (MY) changes - mostly limited to feature upgrades to keep up with consumer’s expectation and continuously defend territory from competition. Phase two starts with a facelift (FL), again followed by successive MY changes. The extent and depth of FL and feature updates depend on the company’s vision and past performance of the product in the competitive landscape. The Ideal PLC timeline in India is 3+3, i.e. facelift after 3 years of launch and generation change after the next 3 years. Usually, a single platform supports two generations of products and varies widely based on the manufacturer’s platform development strategy. MUVs typically have long PLC due to their utilitarian aspect.

Discount or sales promotion is a tactical approach to meet the value perception of the target customer segment. As products age during the product-life-cycle, it may need higher discount provision in business case to counter competitive challenges which change from time to time. Hence incremental discount with product aging is always provisioned in PLC business case. So, the products selling with the least or no discount deliver better value to the customer and in turn create more value for the manufacturer’s investors. However, if products fall short of customer segment expectation, there will be a call for higher discount to lower transactional price and match customer value expectation and push product out of the showroom, thus eroding profit margin, worsening business case and in extreme case, discontinuation of product from market.

Discount is also used as a tool to support sales in declining product segments or adverse market situations to support volume to cover fixed costs. Extent of discount will again depend on product’s inherent strength and weakness.

Based on these key parameters of PLC, we came up with a comprehensive 360⁰ evaluation method, which takes into account several key aspects to know the correct health of the product in the competitive landscape.

PLC timeline : Longer PLC usually means higher discounts in later phase, successful products are an exception

Discounts on offer : Manufacturer/dealer sales push indicator

Market share growth : Acceptance among customer segment

Volume growth : This need to be seen in tandem with discount

Waiting list : Proxy for quality of demand generation

Rating system: best first

Outstanding: Exceptional performer

Good

Average

Below Average

Analysis

The top-10 list is still dominated by Maruti’s products, followed by Tata, now with two products, and Hyundai, with only one product.

SUVs, MUVs, and crossovers are now taking over the top ranks from hatchbacks and sedans.

All hatchbacks were selling at high levels of discounts.

Maruti

Alto slipped out of the top-10 ranking, as entry-level products from Maruti were struggling due to a lack of demand.

Swift displaced the Wagon-R as the best-selling car in India as customers moved to the premium hatchback sub-segment.

Maruti Baleno + Toyota Glanza is the best-selling car (2,44,526) from product per se.

Grand Vitara and Brezza have shown strong growth and amassed higher market share.

Hyundai-Kia

The Hyundai Creta is the best-performing product here. Even in the fourth year of PLC, the product is selling like hotcakes without any discount whatsoever in a highly contested segment.

Entry of Exter has cannibalized sales of i10; however, it is the right transition strategy from hatchback.

Tata Motors

Nexon and Punch remained firmly footed in top 10 ranking.

The addition of new drivetrains has helped Altroz (CNG), Punch (CNG), and Tiago (EV) post good growth figures.

Mahindra

Scorpio N along with the Classic version has had an exceptionally great year and average sales topping the 10,000 mark.

The introduction of RWD versions has helped Thar grow further.

XUV 700 volumes reached its peak.

Toyota

Innova, is back on track without any discount and has remained uncontested so far with its diesel (45%) and strong-hybrid (46%) drivetrain offerings.

2023 new technology and feature focus

Tata took the digital cockpit experience (infotainment/instrument cluster) to a whole new level by integrating Android Auto and Apple CarPlay map displays in the instrument cluster and introducing OTT streaming for its larger 12.3” touchscreen infotainment screen.

Innovative dual-tank CNG packaging from Tata on Altroz and Punch pushed their numbers upward. As there is no compromise in boot space or lack of spare wheel with the said solution.

ADAS features became more common as Hyundai started offering level-1 in Venue too, with a commitment to cover the entire product range by 2025.

LED front and rear connecting light bars became more mainstream as exterior lighting technology had a big impact on the overall appearance of cars. Tata here again introduced the segment-first welcome animation function.