India had emerged as an epicenter for Automobile OEMs to establish their manufacturing facility basis the mentioned advantages –

Setup cost was lower due to comparatively lower real estate value (compared to developed nations).

Trained Manpower Availability (easy availability of technical manpower, blue collar workers, etc).

Lower Manpower Cost (Manpower Cost / Hr remained one of the lowest across the globe).

High Vendor Base (leading to faster & lower cost availability of parts & components).

Government Support (Leading to lower operating & setup costs). Even government run programmes such as ‘Make in India’ attracted enough attention.

Growing Market & Vast Domestic Potential (India’s Automobile Market was one of the fastest growing markets in the world).

India can be established as an Export Base due to central location.

Basis the advantages highlighted above; almost all major OEMs set up their massive manufacturing facilities in India backed by multi billion-dollar investments. We had earlier compiled the list of automotive manufacturing plants – here. However; we have seen that the India is slowly losing the IQ (Investment Quotient) and OEMs are vary of the already heavy investment done in the sub-continent. This has led to global major like General Motors to completely exit the market and even the likes of Ford are considering the cost of their presence in India. One of the primary reasons for the lower viability of the Investment done by the OEMs is – Low Capacity Utilization. Before going to the statistics; let us understand the number of manufacturing facilities of Mass market OEMs in India. There are collectively 25 manufacturing plants set up by 14 Passenger Vehicle OEMs in the Indian subcontinent. Presented here is the statewise manufacturing facilities established –

Maharashtra & Tamilnadu has over 52% of the manufacturing facilities. Pune & Chennai sector has the highest density of manufacturing plants.

Gujarat has gained traction and collectively has 4 plants.

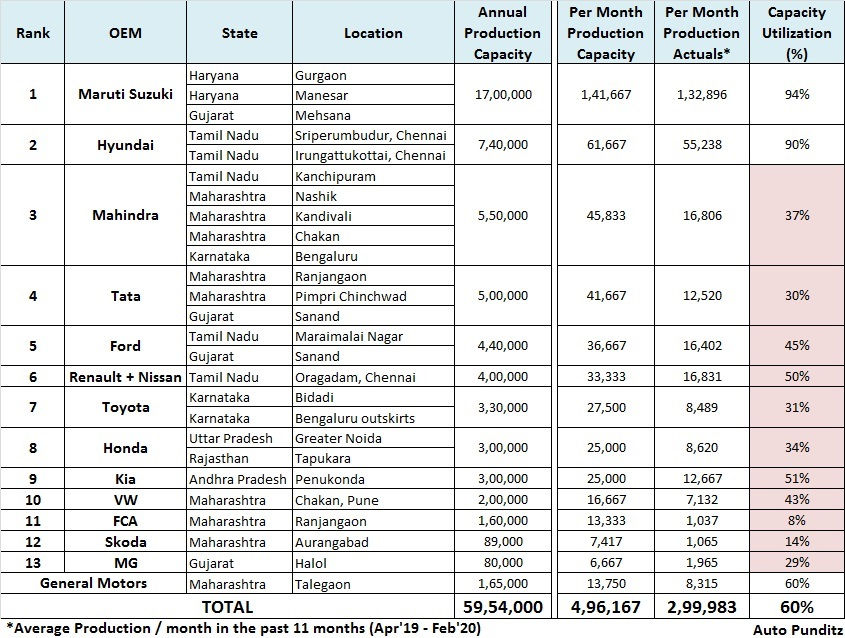

Let us now assess the production capacity of the passenger vehicle OEMs and the actual capacity utilization of these OEMs:

Currently Maruti Suzuki has 3 plants and the capacity to manufacture 17 Lakh vehicles annualy. We have taken the average of vehicles manufactured in the past 11 months and compared with the Monthly Average Capacity. The Capacity Utilization of Maruti is as high as 94%.

Hyundai comes in close second with a production capacity of ~62k units per months v/s actual production of ~56k units per month and capacity utilization is as high as 90%.

However; OEMs like Tata, Mahindra, Toyota & Honda are operating at 1/3rd of the capacity!

Even Ford & RNA (Renault Nissan Alliance) operate at <50% capacity.

Newbies like MG & Kia are better off in terms of capacity utilization as well.

FCA at capacity utilization of only 8% – will be interesting to see how shall the OEM survive with such high operating costs and low volumes.

A lot of money is lost with every minute of underutilized capacity and costs billions to the respective OEMs. It is a matter of time on how these OEMs with low capacity utilization survive the tide.