How & Why Maruti Dominates the Indian Car Market. Top 10 Strategies revealed.

- managementpunditz

- May 29, 2021

- 4 min read

India is the biggest market for Suzuki Motor Corporation (more Suzuki cars are sold in India compared to Japan!). Indian operations remain very crucial to Suzuki’s global growth plan and the company has made some strategic changes that have sustained the dominance of the Japanese carmaker.

Maruti’s plan is very simple – make sure they retain 50% Market Share in the Indian Passenger Vehicle space. After the sudden entry of global biggies (say MG, KIA, VW, Nissan, Renault, etc) it was assumed that Suzuki will have tough times, and maintaining the Market Share will be the biggest challenge. However, Maruti stood the test of time and has put in awe the way several actions were taken to protect its turf. Let’s see the latest performance for reference:

India is the biggest market for Suzuki Motor Corporation (more Suzuki cars are sold in India compared to Japan!). Indian operations remain very crucial to Suzuki’s global growth plan and the company has made some strategic changes that have sustained the dominance of the Japanese carmaker. Maruti’s plan is very simple – target and achieve 50% Market Share in the Indian Passenger Vehicle space. After the sudden entry of global biggies (say VW, Nissan, Renault, etc) it was assumed that Suzuki will have tough times, and maintaining the Market Share will be the biggest challenge. However, Maruti stood the test of time and has put in awe the way several actions were taken to protect its turf. Let’s see the latest performance for reference:

Maruti garnered a Market Share of 47.80% in the recently concluded Financial year. and sold nearly 3 times more than the second-best OEM (Hyundai)!

The reasons for such dominance were:

Premium Positioning – NEXA helped Maruti elevate itself as a premium brand and successfully launch Baleno which later emerged as one of the best sellers in the premium hatch category. XL6 continues to retain its demand and so do the other Nexa cars. The separate dealership network and focused marketing will enable Maruti to launch many premium models in its portfolio.

Clever Technology – SHVS (Smart Hybrid Vehicle by Suzuki) / Mild Hybrid is no revolutionary technology. Rather something similar was incorporated by M&M years back in Scorpio (as Micro-Hybrid). But, the use of SHVS allowed Maruti to gain customer's eyeballs and claim higher mileage as well. SHVS proved to have a dual advantage for the automaker – reduce the price of the models in which it was used and also prove itself as the best fuel-efficient model.

AMT – Automated Manual Transmission went viral in the past 5 years (with the launch of Celerio AMT) and the acceptance was so high that it was later launched in Wagon-R, Dzire, Alto, and almost all cars as well. The adverse traffic conditions in all major cities acted as a catalyst in the change and the intelligently priced AMT worked wonders for Suzuki.

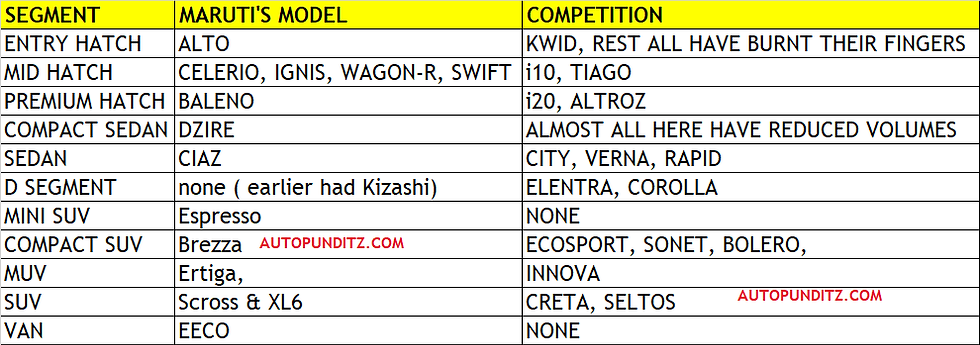

Model-wise Focus – Maruti would be the only manufacturer which will have a segment-leading model in almost all segments! Currently, Maruti does not have a product only in 1 segment (D-segment Sedan). Maruti ensures that it studies the Consumer Sentiment very well and launches an offering that’ll be a runaway success! Let's see how well it has bifurcated its presence in various segments

CNG Focus- While the rest of the OEMs kept chasing and publicizing that Electric cars are here and they have the technology. Maruti made public announcements that they will get the electric car when the market is ready, but for now, CNG seems to be the best alternative. They have made CNG a niche for themselves and have driven strong volumes.

7 out of the Top 10 selling cars are from Maruti Suzuki! Obviously, it is by design and not default.

Taxi Focus – Way before Mahindra’s & Tata’s could ink a deal with Ola’s & Uber’s – Maruti identified a business opportunity and customized its offerings to suit the needs of the end consumer. A taxi-specific model was introduced in the Tour CNG range way back in 2016 and later upgraded to the Entire Tour Range.

Focused Market Approach – The Top 11 cities contribute to over 40% of Maruti’s sales. Hence every additional car sold in these cities helps Maruti strengthen its presence overall. Market/City wise strategy helps them address the local needs much faster and enhance their sale. Look at how things have shaped up this year in the Top cities for Maruti. At the same time intense rural focus has helped Maruti gain very strong footholds in Tier-2 and Tier-3 cities.

Service & Spares Availability – It still remains one of the most important factors for the customer’s decision-making process. The ease of availability of a Service Centre and low maintenance promise has helped Maruti gain the confidence of the Indian Buyer.

The economy of Scale – Maruti+Suzuki's three manufacturing facilities (Gurgaon, Gujrat & Manesar) have a huge joint production capacity. Such scale has allowed Maruti to negotiate prices with vendors and as a result, price its models extremely competitively. It also allows the OEM to dynamically increase the production of the models as per the demand (say Baleno & Brezza).

While many OEMs have tried to replicate the success formula, but the ability of Maruti to execute these with great precision is the standing out difference between Maruti and the rest. However, with newer OEMs along with Hyundai challenging the might in various segments and territories, it remains interesting to see, if Maruti can fight these challenges and continue its dominance.